The startup audit is a scientifically based questionnaire consisting of more than one hundred questions relating to the product, market, finance, team and legal sub-categories of a due diligence, which collects relevant data for investors.

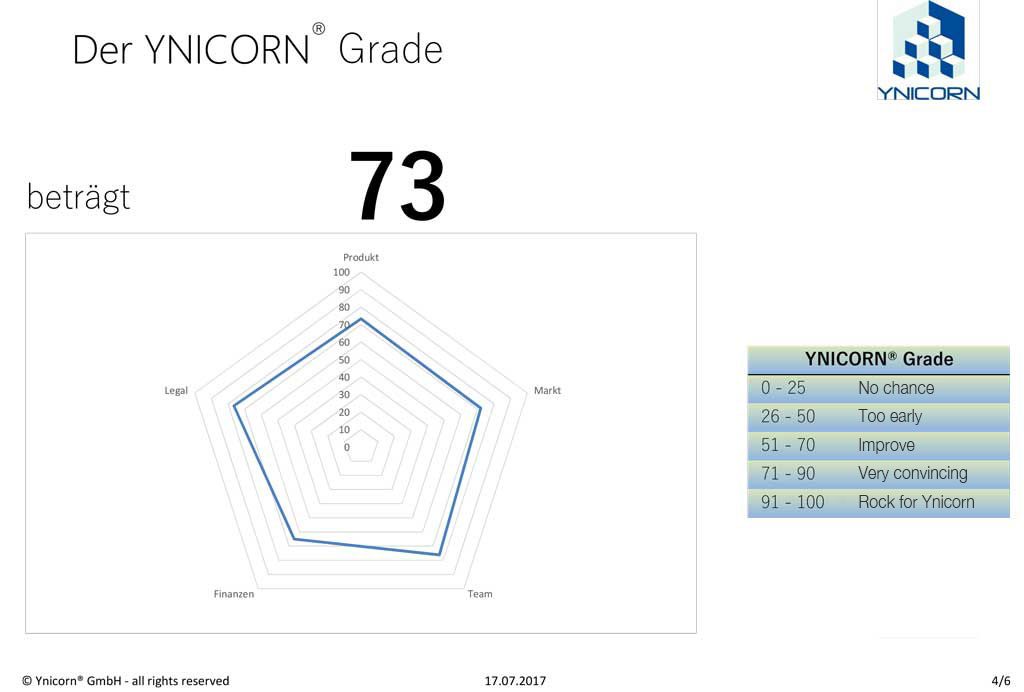

The YNICORN Grade developed by us shows how mature the start-up is for investments. We evaluate the sub-sectors Product, Market Team, Legal and Finance with a maturity between 0-100 points. Furthermore, we determine the Ynicorn degree, which determines a summarizing value between 0-100.

Professional investors have developed criteria that are so important to them that – if unresolved – would cause the investor to withdraw from a deal/investment. These criteria/factors or issues are known as deal breakers. All potential deal breakers are real reasons why an investor has not invested over the years in a specific case.

Below are 10 of our over 100 identified deal breakers, for example:

- The startup insists on signing a confidentiality agreement before sending a pitch deck to the investor

- One of the founders required for business development does not hold a fair share in the start-up company

- Unqualified friends or family members fill management positions in the startup

- Extensive secondary employment of the core team or investments in competitors

- Two of the founders are a couple

- There are competitors equipped with very high investments

- Too many investors have very small stakes in the start-up company

- A software startup does not have a software developer in the founding team

- Uncertain ownership rights to the intellectual property of the start-up company

- Dead equity shares in startup are higher than 10 % (shares of a person who does not contribute to the startup by investing money or time (e. g. exited founders))

- Investors who have already invested in the project will not participate in another financing round without convincing reasons

These deal breakers are even more important for institutional investors such as funds and VCs than for business angels.

In the course of the start-up consultation, a number of factors or issues have emerged over the years which are particularly important for professional investors and which we therefore call (potential) deal breakers.

In the worst case, it may be sufficient that one of these factors or issues is fulfilled, so that the investor decides against an investment. Sometimes it’s that hard. If there are several potential deal breakers, it will certainly be difficult to obtain a funding form a professional investor. Therefore, if you have (potential) deal breakers, you should try to eliminate them or at least try to find arguments or solutions for them before contacting a professional investor.

Why are they just potential deal-breakers?

Investors are not a homogeneous group acting in the same way, so that individual valuations can have different weightings or do not represent a deal breaker for individual investors at all.

Every professional investor has developed his or her own criteria, according to which he or she searches for in a start-up before he or she is ready to invest. However, some criteria are of interest to all investors. We try to identify your deal maker through our startup audit, which sets you apart from the crowd of startups and which you should emphasize in investor meetings.

Below we have listed 10 of our more than 100 identified deal maker, for example:

- A strong, interdisciplinary and motivated team.

- An innovative business idea.

- A significantly better product than the competition.

- High growth potential.

- Going for huge (billion) markets.

- Clear unique selling points.

- Precise knowledge of the target markets.

- Technology is fully protected.

- State subsidies possible.

- You have already shown that you can scale with few resources.

- You have a clear exit focus.

The contract management tool uses a folder structure consisting of 21 main folders and 237 subfolders, which is used for the systematic structured storage and administration of contracts and documents for contract management. You will find contracts and important documents faster and it simplifies contract controlling for monitoring deadlines and (contract) reporting, e. g. for investors. It also serves to systematically collect contract templates and complete your contract pool on an ongoing basis. The folder structure is based on a data room of a due diligence and thus also on the request lists of a potential buyer of the company in the context of a transaction or a professional investor as part of a financing round.

The main advantage of professional contract management is that missing, incomplete or unsigned contracts, e. g. interrupted rights chains, are identified and can be collected internally or requested by third parties before they are requested in due diligence, for example.

With your contract management tool, you can increase your productivity by increasing the clarity and completeness of the data in a central system tailored to your specific needs. You will find relevant contracts and documents immediately, even if they have been processed, signed or filed by another employee. Contract reporting, e. g. for investors, is considerably simplified.

Employee turnover in start-ups is usually quite high. Contract management makes it easy to locate contracts/documents for representatives or successors if the employee responsible is on vacation or has left the company. Collecting the data for audits and, if necessary, for the following financing rounds and the sale of the company are no longer necessary because they are archived in a structured manner. Some further advantages are low running costs if consistently digitized and stored, all relevant contract documents are digitally available and no time pressure when compiling documents for the data room in a transaction.

Yeah. There are specific manual on how to mark and store the contracts etc.

Once we have identified the deal breaker and deal maker, we will create an individual interpretation that is tailored to your business model and give you tips on how you can work on your deal breaker and how you can develop and improve your business model accordingly. This allows you to increase the maturity of your startup so that your chances of finding an investor increase.

Due diligence is a term from American liability law and means “due diligence and care appropriate to the circumstances”. Due diligence is the technical, legal, economic and tax analysis, examination and valuation of a purchased object, e. g. a start-up.

If the contracts and documents are systematically stored in the contract management tool, the time spent by the management in particular for a financing round or the companies sale is shortened tremendously.